The great casual game revival | Pocket Gamer.biz

The mobile games market has evolved over the years, with various playstyles having their moment in the limelight, from casual games to hypercasual and now the hybridcasual model. But with the market becoming increasingly saturated and changes in app tracking transparency presenting a challenge for studios, the market may be ready to undergo another significant shift.

In this guest post, GameAnalytics COO Allison Bilas shares her expertise and insight into the mobile games market history, its current state and potential future. Bilas highlights some big changes within the industry and how the causal model is ready for a glorious comeback.

For those that work in it, the games industry is renowned for going through cycles. On mobile, casual games dominated downloads in the early days. Then we had the ascendance of hypercasual, and now these developers are becoming obsessed with hybridcasual as the circular nature of the industry slowly shifts back to casual once again.

So what’s happening? What do these terms even mean, and how did we get back here?

Categorising the market

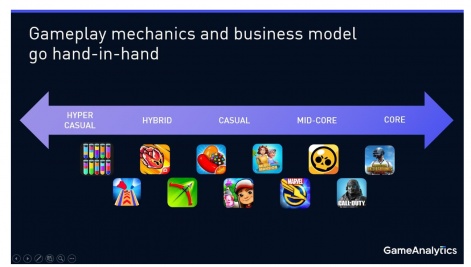

The current mobile market can be summed up by defining game types into five broad categories, as noted on the continuum below. Hypercasual is your pick up and throw away games. You enjoy them for a brief while and then move on to the next thing. These titles are largely defined by simple one touch gameplay mechanics and a heavy emphasis on ad-driven revenue.

Hybridcasual, which sums up the current evolution of that model, keeps much of the simplistic gameplay but adds a deeper layer of progression and allows room for more in-app purchases. Publisher Habby is the leader in the space, kicking off the entire category with Archero before following up with Sssnaker later.

In the middle, we have casual, which includes genres like puzzle (match-3, merge) and endless runners, with titles leaning more into in-app purchases and accessible gameplay mechanics while being built for a large audience. Examples include Candy Crush Saga, Subway Surfers and Merge Mansion. Midcore games have deeper gameplay features but are still designed to be accessible to a wide audience. Titles in this bucket include Supercell’s Clash of Clans, Brawl Stars and Marvel Strike Force.

Then at the end of the spectrum are core games, which can stretch a breadth of genres from hardcore 4X titles like Game Of Thrones Conquest to shooters such as PUBG Mobile. Some of these titles can be particularly monetisation heavy, like in 4X strategy games.

Growth of hypercasual

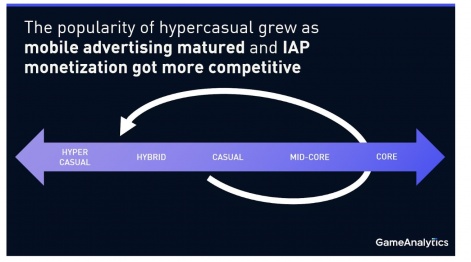

When I started in the industry 12 years ago, hypercasual wasn’t even a term. More ‘typical’ casual games dominated the market, at least in terms of downloads, such as Candy Crush Saga and Angry Birds. There were titles with particularly simplistic gameplay mechanics, such as Crossy Road and Bejewelled Blitz, but this was during a nascent time for mobile ads and revenue generation still largely stemmed from premium and, increasingly, IAPs.

As the mobile market became saturated and more competitive, casual games began adding deeper monetisation and gameplay features (such as the narrative elements seen in Gardenscapes and Homescapes) and a deeper focus on live operations, now the cornerstone of mobile success. Meanwhile, the mobile ads industry was maturing, and smart early publishers identified an opportunity to use user acquisition arbitrage as their primary business model, which they combined with simple and highly accessible one-touch gameplay mechanics. Hypercasual was born and soon defined by Johannes Henize, then at Applovin, in a series of articles.

“These games, which I think of as ‘hypercasual’, have always been around, and to some extent, they are a nostalgic revival of the good old arcade games that were everywhere during the 70s and 80s. But only recently have these games turned into serious business,” he described at the time.

Eventually, the hypercasual business model as we know it today became based on a 100% ad revenue model, with simple gameplay, low-quality graphics and rapid development cycles. Historically, leaders such as Supersonic, Voodoo and SayGames would develop and/or publish dozens of hypercasual games each year with enormous UA investment, flooding the top download charts.

As Deconstructor of Fun called them, these are like the bubble gum of the games industry. “Super tasty. Everyone loves them. They come in all flavours. You chew them for a bit and spit them out until you pop the next one in.”

In 2022, Data.ai estimated that hypercasual games generated some 17.5 billion downloads worldwide across the App Store and Google Play, accounting for 29% of the total mobile game installs.

Evolution of hypercasual

But the good times are over. With Apple’s deprecation of the identifier for advertisers (IDFA), the hypercasual business model (and the mobile ads ecosystem) has been significantly hindered. Targeting user’s post-app tracking transparency (ATT) is a serious challenge, with the cost of acquiring players rising. Meanwhile, Apple has just announced Privacy Manifests that could be the final nail in the coffin for fingerprinting (which basically circumvents Apple’s privacy rules), and Google’s own changes, such as Privacy Sandbox, are following in tow.

There is now pressure on hypercasual developers to be more competitive with IAP monetisation and retention mechanics and thus move toward casual, or what some are labelling as hybridcasual. As explained earlier, this game type sits between hypercasual and casual, adding a layer of progression, and allowing for IAPs to sit alongside ads as a revenue generator.

I’m not saying hypercasual is dead, as Voodoo’s Alex Shea famously declared (while the publisher is also shifting to just four game releases per year), but it’s become a market ripe for necessary disruption.

As a result, I believe the market is now in a casual game revival. Hypercasual game developers will no longer be pumping out content en masse as they have for publishers. They’ll likely adapt to this new norm in one of two ways:

1. Launch and adapt

Hypercasual developers can still launch titles in this genre, but those that succeed will be adapted and grown into hybridcasual or casual titles rather than left for the next big hit. An example is Voodoo’s Mob Control, which was released as a hypercasual game before integrating new mechanics, progression systems and live ops.

On the one hand, it’s a tricky transition for hypercasual developers to make, as it requires a change in skillset. On the other hand, that same skillset can also be applied when moving into the casual space, as rapid development in a live ops setting means teams can still focus on constant releases but within the same game instead.

2. Start with a blend

Developers may take the Habby route and purposefully design games with mass market appeal while integrating deeper monetisation design from the start. Habby remains the clear leader in this hybridcasual space, but companies such as SayGames, Homa, Kwalee and others are all making a play for it. You could even argue that much of this is actually the definition of casual gaming. These titles may not use merge or match mechanics, for example, but they have all the other trappings.

Hypercasual’s innate similarities to casual

While hypercasual and casual business models are fundamentally different (one focuses solely on ads, and the other leans heavier toward IAPs, but not necessarily exclusively), it may surprise you that there are key similarities between them.

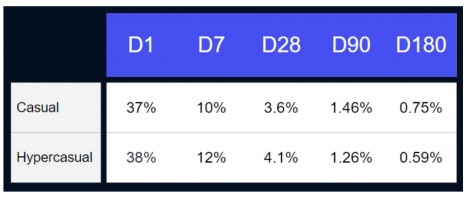

Utilising GameAnalytics data, we analysed over 1,000 games, including 700 casual titles and 300 hypercasual games, each with more than one million monthly active users.

Studying day 1 to day 180 retention, data showed that retention among titles across these genres is surprisingly similar. For day 1, retention rates among casual games are 37%, while hypercasual is 38%. Meanwhile, day seven retention rates show 10% for casual and 12% for hypercasual. Day 180 shows a slightly larger difference of 0.75% for casual and 0.59% for hypercasual, but these gaps are still not statistically significant.

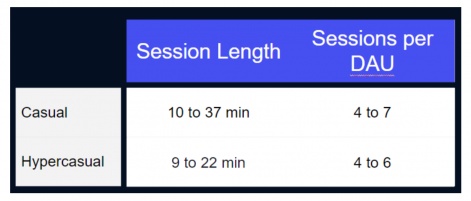

As for engagement, there are some differences and similarities. As the chart below shows, total play time per day is 10% to 95% greater in casual games (a total difference of five minutes to two hours more). However, looking at the number of sessions per daily active user, we can see this figure is very similar.

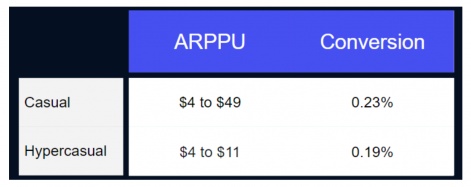

Analysing IAP monetisation, there are again differences and similarities. Casual games, as expected, command significantly higher average revenue per paying user. However, conversion rates are similar. While it’s well-known that converting players to paying has always been challenging, GameAnalytics data shows that there has been a downward decline in IAP conversion during the past 12 months across all genres.

Design principles for modern casual games

With a shift away from the hypercasual model, there are some fundamental design principles to keep in mind for the great casual revival.

1. Adding complexity

As explained earlier, hybridcasual and casual titles feature extra layers of gameplay mechanics, progression and monetisation, making them slightly more complex. When shifting from hypercasual, any complexity you add should be in the meta, not the core loop. It goes back to the old gaming age of ‘easy to play, hard to master’, a statement that’s true for most games, but particularly for this migration. Like with hypercasual, players must immediately understand how to play the game and know why they won or lost.

2. High quality

Hypercasual could get away with low quality graphics and animations, but in more complex titles, higher quality is required. Competition like Candy Crush Saga and Royal Match, for example, are very polished experiences, while hybridcasual titles like the aforementioned Sssnaker and Archero from Habby raise the bar for how the genre is defined.

One recent example, Tactile Games’ Makeover Match, is another example of a polished casual game. This is what should be expected when moving up the continuum from hypercasual to casual and beyond.

3. High output

Rapid development will continue to be important for studios in finding the next big hit. The high output from hypercasual publishers does not necessarily have to be a thing of the past. Even other players in the casual space regularly test new games, but often in a more subtle and hidden way.

With more shots on goal, developers could find a successful formula to capitalise on. Meanwhile, that same culture, which is a superpower of hypercasual publishers, can also be harnessed in live ops development for regular new content.

4.Player-level engagement

Live ops is a crucial element for any successful mobile game in the modern market. Keeping titles updated with new content and events is what keeps games at the top of the charts and has even become a minimum requirement for players.

It’s important to regularly test to learn what works for your players and what doesn’t. By analysing gameplay data, developers can monitor player behaviour and spot design issues, such as where players might churn, level progression, reaction to new updates, in-game economy balance and IAP validation, etc.

5. Creatives pipeline

While ATT has shaken the foundations of the entire mobile market, UA remains very important and is still the best method of bringing players to your game. As ever, marketers need a regular pipeline of fresh creatives that are regularly tested and refined for optimal impact. It’s more challenging than ever to find the right players, and it’s also an expensive endeavour, so regular testing of creatives and forward-planning for new ones is critical.

6. Bundled mini-games

According to GameRefinery, 77% of casual games have integrated some form of mini-game. This is typically entirely for UA purposes, with creatives based on these mini-games (or mini-games based on successful creatives) used to reach larger audiences and reduce reliance on targeting. Another benefit of mini-games is adding another layer of fun to a game, shaking things up and potentially helping improve retention.

Examples of these mini-games include Homescapes’ pull the pin, while Glu Mobile’s Flavour Quest features a raft of different mini-games.

7. Consider cross-platform

This is not a necessity by any means, but the mobile games market has become challenging enough to compete on that developers and publishers may consider pivoting to a cross-platform approach or even developing for other platforms entirely. We’ve seen the likes of Kwalee, Kabam and Scopely adopt cross-platform and PC/console development approaches, given the large revenue fees taken by Apple and Google and the difficulties with UA.

Alternative options include Steam, browser gaming, and even UGC platforms such as Roblox and Fortnite, which are home to hundreds of millions of players. But these platforms and gaming ecosystems are not always an obvious fit, particularly for hypercasual publishers.

The great casual revival

ATT has undoubtedly shaken up the status quo in the mobile games market, with hypercasual in particular on the hook. But with these challenges comes a market that’s also ripe for disruption.

The great casual revival will see developers and publishers adopt a more traditionally casual category approach. Ultimately, I think the current hype around hybridcasual confuses what developers should focus on: live ops. This is particularly relevant given the current market conditions, which greatly impact UA arbitrage and ad monetisation as a whole. Failure to focus on this aspect could see publishers losing out amid this shift.

Hypercasual isn’t dead, but the mobile sector is ready for change, borne out of necessity. Years from now, the top downloaded games are set to look very different from what we’ve become accustomed to during the previous decade, with much less focus on ad-only monetisation.

Edited by Paige Cook