Japan’s consumer spend set to surpass $12.6 billion in 2023 | Pocket Gamer.biz

Japan’s 70 million mobile gamers are set to spend more than $12.6 billion on mobile gaming by the end of 2023, according to a new report by Adjust and Data.ai.

The report notes the exceptionally high value of Japanese gamers, who ranked first in terms of monthly spending on iOS worldwide ($10.30 per device) and second on Android ($9.80) in 2022. A survey conducted in July last year found that 92% of Japanese smartphone users played games at least once a week, with 65% doing so every day.

Q1 2023 saw consumer spend hit a total of $3.41 billion, representing a 13% increase from Q4 2022.

The RPG genre remains the jewel in Japan’s crown with combined consumer spend hitting $1.79 billion – 52.5% of the total, and a 7% quarter-on-quarter increase. This was followed by simulation ($520 million, up 30% quarter-on-quarter) and strategy games ($349 million, a 4% quarter-on-quarter increase). The hypercasual genre accounted for just $2.5 million in consumer spend, but saw the strongest quarter-on-quarter growth at 56%.

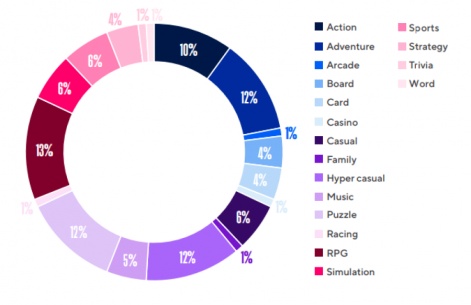

RPG titles also came first in terms of gaming app installs at 14%. Hypercasual, puzzle, and adventure games all tied for second place at 12%. Taken together, this data suggests that while the hypercasual genre is growing more popular in Japan – a country which has traditionally been a tricky one for it to crack – it still struggles to convert these players into payers.

Adventure games saw the largest growth in installs, with a massive 46%. This was followed by action at 23% and sports at 13%.

As a whole, gaming installs are on the rise in Japan. 2022 saw a notable dip in downloads, declining 22% year-on-year. January 2023 showed the first signs of recovery, with installs standing at 30% above the 2022 average. Meanwhile, downloads in Q1 2023 increased 12% quarter-on-quarter, above the 9% global average.

The battle of the platforms

Japanese consumers have a distinct affinity for iOS devices, with 61% of the games tracked by Adjust being iOS based. However, there were strong preferences for different genres. The adventure genre saw particular success on Apple devices, which accounted for a massive 90% of all the genre’s downloads. In contrast, Puzzle saw 60% of its downloads come from Android users.

Despite the increase in hypercasual downloads, the report notes that the genre had the highest paid vs. organic ratio for downloads at 2.45. This suggests a heavy reliance on paid user acquisition strategies.

Although the share of paid installs dropped overall, gaming apps maintained a steady number of partners quarter-on-quarter, with an average of four per app. The hypercasual genre works with more partners than any other genre, with a median number of six.

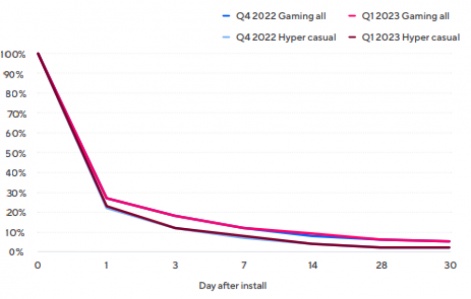

Retention rates remained steady quarter-on-quarter. The entire industry saw an average day one retention of 27%, which dropped to 18% on day three, declining steadily throughout the coming weeks, although Q1 2023 saw a 1% uptick in retention on day 14, at 9% compared to 8% for Q4 2022. As another signifier that hypercasual games are slowly gaining traction in Japan, the genre’s median percentage was 1% higher throughout the 30 day period.

At 32%, the RPG genre saw the highest day one retention rate, followed by simulation at 30%, puzzle at 28%, and sports at 27%. Hypercasual retained the least users, despite its increases compared to Q4 2022, with a day one retention rate of 23% compared to 22% in the previous quarter.

Despite pulling ahead in terms of downloads and revenue, the RPG genre only came in second place in terms of sessions, accounting for 18% of sessions compared to 19% for puzzle games. Hypercasual titles, meanwhile, accounted for just 1%. In total, Japan saw a 6% quarter-on-quarter increase in sessions, and the company is optimistic about further growth.

Overall, session length has increased, with an average of 26.59 minutes in Q1 2023 compared to 26.15 minutes in 2022. The RPG genre proved to maintain user attention for the longest period, increasing from 38.1 minutes in 2022 to 40.22 minutes in Q1 2023. Hypercasual session length also grew dramatically, from 17.25 minutes in 2022 to 20.6 minutes in Q1 2023. Once again, this indicates that the genre’s fortunes may be improving.

Earlier this month, Sensor Tower examined Japan’s top earning mobile games.