India accounted for 15.29% of game downloads in the first six months of 2023 | Pocket Gamer.biz

India is one of the world’s fastest growing mobile gaming markets, and it may be even further on the rise as it tops even Brazil and the United states for total games downloaded in the first half of this year.

A new report by Apptica shows that consumers in the market downloaded 4.32 billion games, accounting for 15.29% of the total, a 0.9% rise compared to the same period in 2022. This was followed by Brazil at 2.99 billion (10.59%) and the United States at 2.57 billion (9.08%.)

China, which has long been the world’s largest mobile-first gaming market, came in sixth place in terms of downloads with 1.3 billion, representing 4.59% of the total.

Despite its dominance in terms of downloads, India failed to rank among the top 15 markets in terms of revenue. At $5.71 billion, the USA came in first place with a market share of 26.61%, compared to 22.61% in the same period of 2022. This was followed by Japan at $4.17 billion (19.43%) and China with $3.32 billion (15.05%).

In terms of platforms, Google Play dominated downloads, accounting for 88.63% of the market, compared to just 11.37% for the App Store. However, the App Store pulled ahead in terms of revenue, accounting for 56.26%, while Google Play accounted for 43.74%. This suggest that, while Android comes close to equalling iOS in terms of revenue, individual users are spending far more on average on iOS than Android.

Market dominance

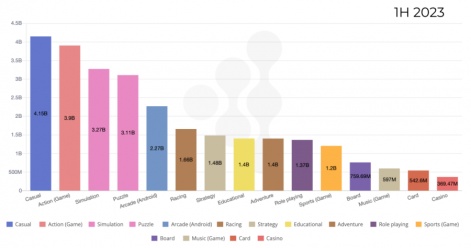

Most genres saw declines in downloads in H1 2023 compared to the same period in 2022. Casual games came in first place in terms of downloads with 4.15 billion, compared to 4.25 billion in the first six months of 2022. However, the genre increased its market share by 0.62%.

The genre saw the largest market share in the majority of countries worldwide. The genre proved particularly popular in Portugal, where it saw a market share of 18.9%. In contrast, Indonesia saw the casual genre account for just 13.2% of downloads.

Action, the period’s second most popular genre, saw its share drop from 4.29 billion to 3.9 billion, with a market share reduction of 0.18%. Simulation games came in third place, with 3.27 billion.

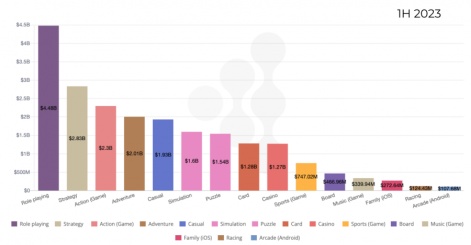

In terms of revenue, all genres saw year-on-year declines, representing an ongoing trend of decline as the market normalises following the so-called “Covid boom”.

The three highest earning genres remain unchanged from H1 2022. RPG once again proved to be the period’s dominant genre in terms, generating $4.48 billion in revenue, compared to $5.91 billion in the same period last year. The genre also saw its market share decline by 3.2%. This was followed by strategy at $2.83 billion and action at $2.3 billion.

The casual genre, despite dominating in terms of downloads, generated $1.93 billion in H1 2023. Likewise, RPG’s downloads were relatively low, with the genre coming in tenth place with 1.37 billion. This suggests that, while the casual genre maintains its popularity with consumers, it struggles to effectively convert those users from players to payers. In contrast, the RPG genre is more attractive to high-value consumers who are willing to spend money.

RPG saw strong performance in several markets in terms of revenue, and proved exceptionally profitable in South Korea, where it accounted for a full 47.6% of mobile gaming earnings. However, the genre faltered in Italy and Spain, with a share of just 12.2% in each country.

Subway Surfers once again showed a strong performance, being Android’s most downloaded title with 116.5 million over the period, and number seven on the iOS charts. At 32.2 million downloads, Eggy Party came in first place on the iOS charts.

Coin Master emerged as Android’s most profitable title of H1, with $228 million. However, it was Honour of Kings that emerged as the uncontested ruler on the iOS, with $766 million.

In January, Apptica reported that Android has a 71% share of all advertising traffic.