Drake Star’s Global Gaming Report: Breaking down the numbers, charts and more | Pocket Gamer.biz

With the release of their latest Global Gaming Market report, Drake Star Partners have revealed a whole host of new insights into the financial health of the gaming industry.

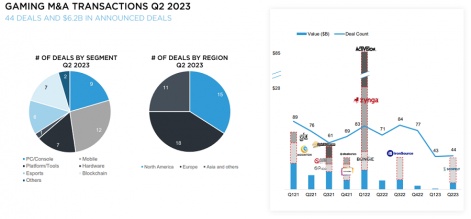

As noted in our previous coverage of their report (available here), although there seems to be a consistent rise in investment and M&A, we’ve seen private deals dip somewhat and the market is yet to reach the huge peaks seen in 2022, where Q1 boasted 83 deals with their value primarily driven by the massive Zynga acquisition.

What’s new in the world of money?

First things first we should examine their charts on M&A transactions so far, as this provides a helpful timeline on the performance of deals in M&A over the past two years. We can see the aforementioned peak in Q1 2022 that has also driven much speculation about when, or if, the gaming industry is going to get back to that peak in the near future.

Given the size of the Activision Blizzard acquisition, which has been anticipated to close this year, we may see this peak overcome when that closes. However, like the Zynga acquisition it would also mean the peak is highly weighted towards a single company. So, arguably the ratio for other companies is still quite high despite the lower value overall. The drop in deals could also be attributed to that high number – essentially with a peak of M&A it means we’re likely to see a dip as companies settle in and those serial acquirers look for more options in the meantime.

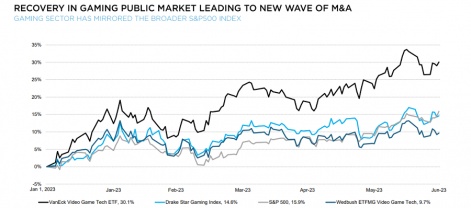

While things were much leaner in the Jan-Feb period, as pointed out by Drake Star we can see a significant uptick around march. The S&P 500 as a “broader” index means that it covers more than just the gaming industry, so this rise is in conjunction with broader economic trends.

However, we can likely make a judgement that – if reasons for gaming to rise specifically need to be considered – the end of the licensing freeze in China and the slow but steady progress of the Activision Blizzard acquisition has helped drive this growth.

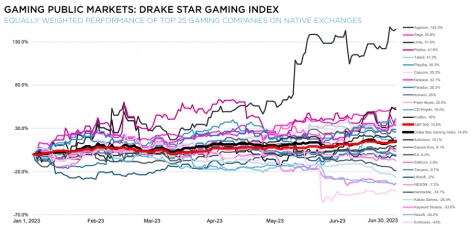

The Top 25 gaming companies and their performance also offers a startling contrast in fortunes for many companies. Applovin for example began to soar in May, while, naturally Embracer saw a plummet to rock-bottom after their disastrous financials and the falling through of a $2bn deal in early June. Embracer’s fall could also be a reason to consider the lesser number of M&A deals, as their business model was heavily weighted towards constant acquisitions, other participants may be rethinking their moves as a result.

It would seem, judging by the dip in the Drake Star Gaming Index around this point, that Embracer’s high-profile drop in fortunes – as well as the the poor performance of NCSoft and Keywords Studios, both down more than 30% – helped to drive down the performance of this index. Ironically it’s the flip-side to the confidence that the currently quite likely completion of the Activision Blizzard offers, in that the fortunes of a massive company can either dictate an increase or a drop in the broader market’s performance.

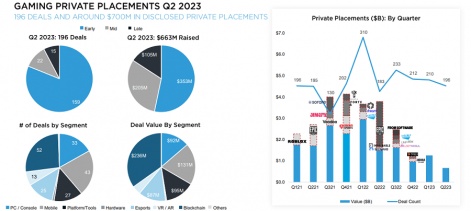

Private placements have been relatively healthy in the meantime. With Q4 2021 and Q1 2022 seeing the highest peak in the last two years, as can be seen below. It would seem placements are on a bit of a downward trend after this peak, although still remaining just above the same comparable quarter in 2021.

Overall, while it seems M&A is indeed back and swinging, it’s yet to reach the same heights it once did at a peak in 2023. But, as previously stated, although it may artificially inflate the index the Activision Blizzard deal will not just be good for gaming in general but mobile specifically. All eyes are on what Microsoft does once the acquisition is completed, and hopefully that means their expected emphasis on mobile will propel investment into the sector.

Certainly, acquisitions such as Scopely and Rovio by much larger companies have been major stories outside of the specific mobile niche. So in the absence of other major acquisitions, mobile is leading the way in terms of money.